Policy Brief

Long term care

Introduction

Jersey, unlike the UK, has arrangements to help meet the cost of long-term care. The cost of the scheme has increased more than expected. As a result, the government is proposing to increase the contribution rate from 1.5% to 2.5% of incomes with effect from 2027. This Brief covers the history of the scheme, how it operates, financial trends and policy issues.

Summary

Long-term care is a significant public policy issue in many countries.

The key issue is that with an ageing population a growing number of elderly people cannot look after themselves and need support.

The Long-Term Care (Jersey) Law 2012 provided for the introduction of the Long-Term Care Scheme with effect from 2014, funded by an additional tax on income and a government contribution.

Eligibility for the scheme depends on meeting residential requirements. The support covers care and living costs in a care home, care costs in own home and, if eligibility requirements are met, income support to meet living costs.

Taxpayers pay an additional 1.5% tax to fund the scheme. The rate was introduced at 0.5% in January 2015, increased to 1.0% in January 2016 and to 1.5% in January 2020. The government also makes a contribution. In 2024, contributions totalled £47 million, the government grant was £37 million, and benefits paid totalled £82 million.

There have been two actuarial reviews of the scheme. A review as at December 2021 concluded that contributions were more than sufficient to meet levels of expenditure, and that that was expected to remain the case until 2029. Thereafter, the breakeven contribution rate was projected to increase to 2.0% by 2041 and to 2.5% by the end of the projection period (2047).

However, benefit payments have increased more than anticipated, largely because of an increase in the number of people receiving benefits. This has prompted the government to plan for an increase in the funding rate by 1.0 percentage point to 2.5% from January 2027. A review of the scheme is also being undertaken. That review will need to analyse how the cost of the scheme has risen much more than had been anticipated in the most recent actuarial review.

There are four options for addressing the increased costs –

- Tightening the eligibility criteria, such as increasing the period for which costs must be paid before there is an entitlement to benefits.

- Reducing benefits, for example meeting a smaller proportion of the cost of care.

- Increasing the contribution rate as envisaged in the proposed budget.

- Increasing the taxpayer contribution.

None of these options is politically attractive, but one or more of them must be pursued. That requires a political decision to be taken.

The general issue of long-term care

Long-term care is a significant public policy issue in many countries. The key issue is that with an ageing population a growing number of elderly people cannot look after themselves and need support. That support can be given in three ways –

- Informally by family members.

- Home visits or care home accommodation funded privately.

- Home visits or care home accommodation funded by the state.

The provision of support is costly. Care homes typically cost around £7,000 a month and the duration of care is uncertain. The problems are compounded by difficulty in recruiting staff by care providers. The funding pressures mean that pay is relatively low and, even then, care homes struggle to be viable.

Governments typically meet some long-term care costs for those who cannot meet costs themselves. However, most long-term care has to be provided or funded privately. This can involve running down savings and selling the family home. This is seen by some to be unfair, particularly as some people have all their care costs paid by the state.

There have been many attempts to devise schemes to mitigate the costs falling on families. Typically, these involve the state meeting costs once a threshold has been exceeded. But setting the thresholds is at best a difficult task and more difficult as governments are reluctant to meet any costs, and raising taxes to pay for a scheme is unpopular. It is for these reasons that, despite numerous reviews, including one now under way, no scheme has been introduced in the UK.

Jersey’s long-term care scheme

Jersey is one of the few jurisdictions that has a long-term care scheme.

The rationale is set out in a report to the Assembly in August 2013 Long-term care scheme. The report stated –

The new scheme will provide financial support to Jersey residents who have significant long-term care needs and who are being cared for either in their own home or in a care home. The LTC benefit is a universal benefit that will be available to everyone without reference to their income or assets. A number of LTC benefit rates will be provided to reflect the costs associated with differing levels of long-term care needs. The universal LTC benefit is not designed to cover the full costs associated with long-term care. Some of these costs will still fall to the individual, and additional means-tested LTC support will be provided for those who cannot meet their share of the total cost of care.

To qualify for the LTC scheme, an individual will need to satisfy the following conditions –

- ordinary residence in Jersey either for ten years immediately before applying, or for ten years as an adult in the past and for another year immediately before applying

- be aged 18 or over care must be provided at an approved care home or through an approved care package at home

- the individual’s care needs must have been assessed as being above a minimum level.

The key feature of the scheme was described as “Anyone with long-term care needs will be able to claim the universal LTC benefit once their eligible care costs reach the lifetime care costs cap of £50,000 (2013 prices)”.

A fund would be established from contributions by Jersey residents with income high enough to pay income tax and the States would also make a contribution. The contribution rate was originally set at 0.5% in 2015, rising to 1.0% in 2016. The intention was to hold the rate at 1.0% for at least three years. The States contribution was set at £30 million, equivalent to what was already being paid to support long-term care costs. The scheme is operated on a “pay as you go” basis (today’s contributions paying for those claiming the benefit today) with a small buffer built up to protect against temporary variations.

Current arrangements

The Long-Term Care (Jersey) Law 2012 provides the legal framework for the scheme. The operation of the scheme is described in Long-Term Care Scheme General Information . The key points are described in a page on the Government website Long-term care scheme. It sets out three routes for accessing the scheme.

Route A: If assets, including the value of a home, are below £419,000, there is entitlement to financial assistance as soon as the person starts to receive care at an agreed level. The support covers care and living costs in a care home, care cost in own home, and, if eligibility requirements are met, income support to meet living costs.

Route B: If assets and the value of a home are worth more than £419,000 and savings are more than £25,000, then own care costs up to a threshold, currently £77,220, must be met before the benefit can be accessed. Depending on the level of care required it takes between one and three years to reach that threshold.

Route C: If the value of all assets, including a home, is more than £419,000 and assets other than the home are worth less than £25,000, a property bond is available to protect against the need to sell a home to meet care costs. It offers the option to borrow against the value of a home without the need to sell it.

A care assessment is undertaken to assess how much care a person needs.

The maximum weekly benefit is between £523 and £1,451. The benefit does not cover the full costs of care. A copayment must be paid and those receiving support can also choose to pay for a better standard of care.

Funding

The scheme is largely funded by taxpayer contributions, paid with income tax. The government website states -

The maximum long-term care contribution rate is 1.5%, but most people will pay less than this.

This works in the same way as income tax where the standard tax rate is 20%, but most people pay less than 20% tax on their annual income.

Your contribution is based on your total income, but will take into account the same tax allowances and reliefs you benefit from and a marginal long-term care rate of 1.95%.

This is rather confusing. A simpler description is that an additional tax rate of 1.5% is paid by those liable to income tax up to the upper earnings limit for social security (£317,304 for 2025). The rate was originally introduced at 0.5% in January 2015, increased to 1.0% in January 2016 and then to 1.50% in January 2020.

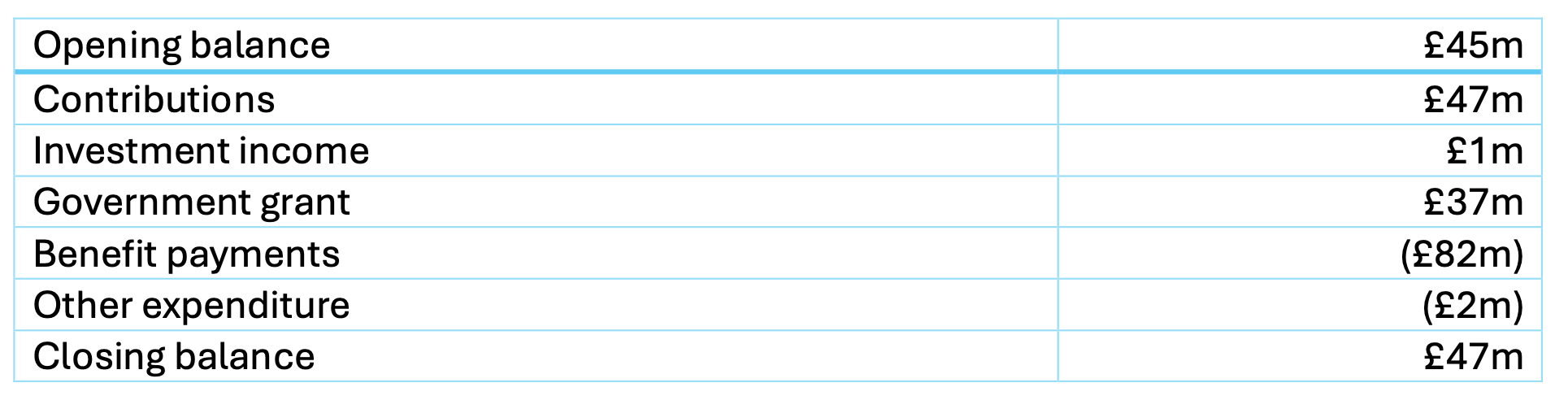

The following table shows the state of the Long-Term Care Fund in 2024.

Long Term Care Fund, 2024

Source: States of Jersey Group Annual Report and Accounts, 2024.

Reviews of the operation of the scheme

The law requires actuarial reviews to be conducted every three years. The first review States of Jersey Long-Term Care Fund Actuarial review as at 31 December 2017 stated -

It can be concluded from the central scenario results that, without a change to the current operation of the Fund (either through a change to benefits or an amendment to the LTC contribution rate), the Fund is not sustainable beyond the immediate future. Indeed, the breakeven LTC contribution rate is estimated to be higher than the current rate of 1% in the short term, rising to 1.5% by 2028 and to 2.5% by 2043.

In February 2022 the Comptroller and Auditor General published Long term care fund. The key findings included –

- The percentage of Jersey adult residents who live in residential care settings is considerably higher than comparative data for England.

- The processes underpinning the LTCS are complicated and, in some instances, inefficient. Some systems and processes are in need of improvement to eliminate duplication of effort and to manage risk more effectively.

- The guidance available to claimants on the LTCS is complicated. The information and guidance provided by the Government should be streamlined, simplified, and made more accessible.

The conclusions included –

- From the evidence reviewed, the LTCF and LTCS have met their intended policy objectives.

- At an operational level, there is an opportunity to review, simplify and streamline the systems and processes that underpin the LTCS as well as the guidance and tools provided to support claimants.

The second actuarial review was delayed because of Covid. The Government of Jersey Long Term Care Fund Actuarial review as at 31 December 2021 was published in May 2023. This includes a good description of the operation of the scheme.

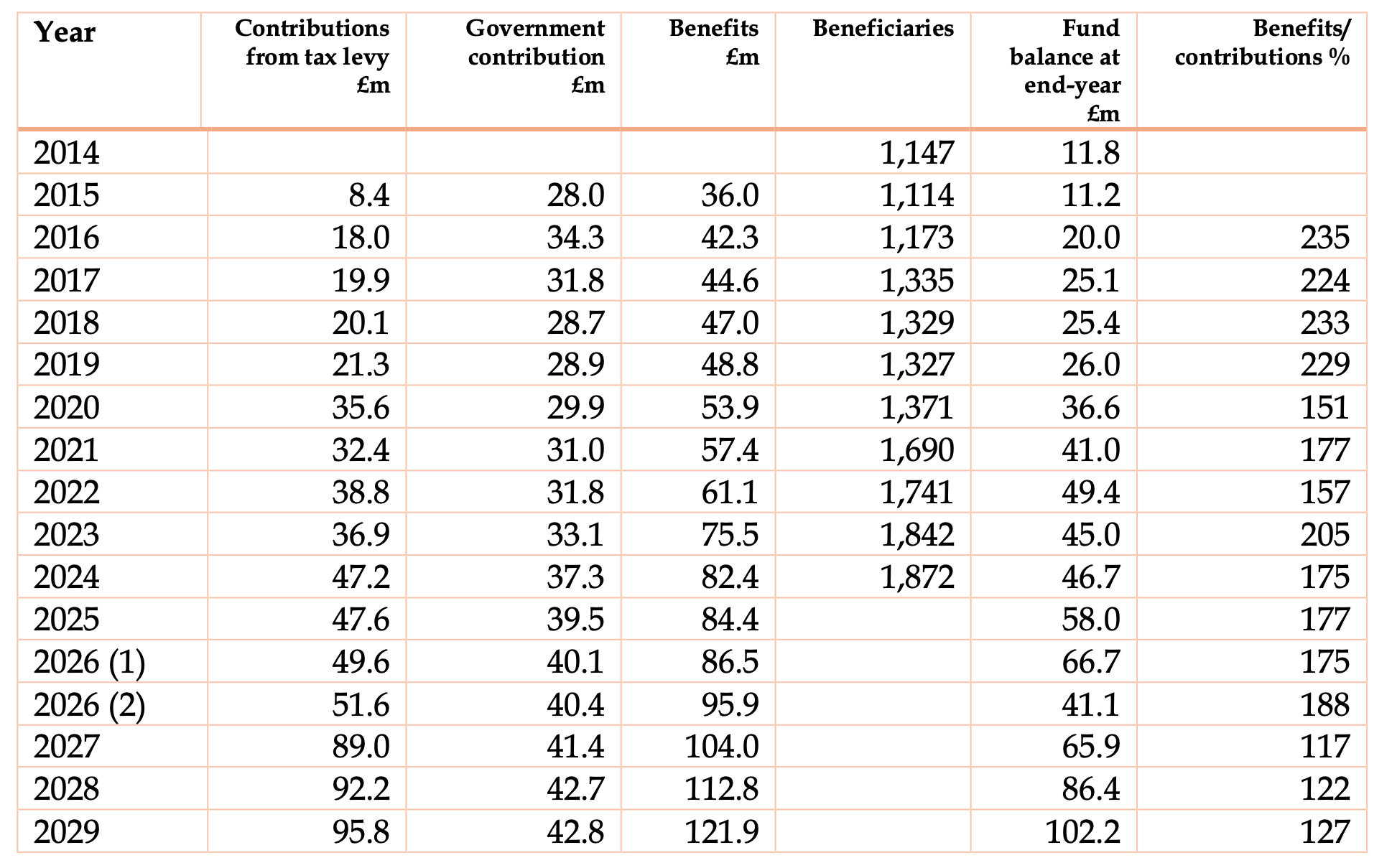

Its central projection was that in real terms expenditure would increase from £61.3 million in 2022 to £70.2 million in 2027 and £88.8 million in 2037. It projected a breakeven contribution rate of 1.3% in 2027 and 1.9% in 2029. On the adequacy of contributions, the report stated -

Current LTC contributions are more than sufficient to meet current levels of expenditure, and that is expected to remain the case until 2029. Thereafter the breakeven contribution rate rises to 2.0% by 2041 and up to 2.5% by the end of the projection period (2047).

At some point is likely that the contributions will need to be increased (assuming benefits are not significantly reduced). There is not a financial imperative for that to be done in the immediate future, although equity between generations may suggest an earlier increase than is required by the financial position of the Fund.

The proposed increase in the levy

Benefits have increased substantially in recent years, from £61.1 million in 2022 to an estimated £95.9 million in 2026 and £104 million in 2027. The £104 million contrasts with the estimate for that year in the 2021 actuarial review of £70.2 million. However, the £70.2 million is at 2022 prices and equates to about £88 million in 2026 prices, still significantly below the anticipated figure of £95.9 million.

This situation has prompted a proposal to increase the funding rate by 1.0 percentage point to 2.5% from January 2027. This contrasts with the 2021 actuarial report which suggested a breakeven rate of 1.3% in 2027 and with a need to increase the rate to 2.5% not until 2047.

The Proposed Budget 2026 includes the following.

Costs are increasing rapidly at present driven by a combination of demographic changes and the increasing complexity of care packages. There has been a sharp increase in costs since the preparation of the 2025 Budget and future costs are forecast to continue to rise steeply over the next few years.

Urgent action is now needed to maintain the Fund. This can be achieved by increasing the contributions into the Fund or by reducing the range or value of benefits provided from the Fund.

The estimates for 2027 to 2029 [in the table below] include an increase of 1 percentage point in the LTC contribution rate from 1 January 2027. Any rate change will require legislation and a States Assembly debate. Ministers have instigated a detailed internal review of the LTC scheme to consider the way in which benefit levels are set and income and assets of claimants are taken into account as well as the way in which services are delivered. The outcome of this detailed review will be available to the incoming Council of Ministers in summer 2026 to allow for a decision to be made during 2026 as to the actions needed to increase contributions into the Fund and/or reduce the generosity of benefits paid out of the Fund for future new benefit applicants, to ensure the sustainability of the Fund in coming decades.

The table in the Appendix shows that the effect of an increase in the contribution rate is to increase contributions from £52 million in 2026 to £89 million in 2027. For comparison, in 2027 personal income tax is projected to be £823.5 million. However, the table also shows that much of the proposed increase will not be to fund benefits, but rather to increase the balance in the fund from £58 million in 2023 to £102 million in 2029.

Issues

The internal review will no doubt consider how the cost of the scheme has risen much more than had been anticipated in the most recent actuarial review. At first sight, it may be the case that the assumptions used in the review did not take sufficient account of the impact of providing generous benefits on the demand for those benefits. It was assumed for example that the proportion of people in care would remain at the level that applied when the review was undertaken and similarly that the proportion of individuals in each care level would be unchanged. There has been a huge increase in the number of people receiving long term care, from 1,371 in 2020 to 1,872 in 2024. As the population was static in this period there was a 36% increase in the proportion of the population receiving long term care benefits rather than the assumption of no increase. Accordingly, the forthcoming review needs to take account of the impact on demand of different levels of benefit.

There are four options for addressing the increased costs –

- Tightening the eligibility criteria, such as increasing the period for which costs must be paid before there is an entitlement to benefits.

- Reducing benefits, for example meeting a smaller proportion of the cost of care.

- Increasing the contribution rate as envisaged in the proposed budget.

- Increasing the taxpayer contribution.

None of these options is politically attractive but one or more of them must be pursued. That requires a political decision to be taken.

Appendix Key statistics

The following table shows key statistics for the operation of the scheme.

Jersey’s long-term scheme, key data, 2014-2029

Sources:

1. The figures in the beneficiaries column are taken from the opendata archive.

2. The remaining figures from 2014 to 2024 are taken from the annual accounts of the States of Jersey Group.

3. 2025 and 2026 (1) figures are taken from the Budget (Government Plan) 2025 – 2028.

4. 2026(2) and 2027-29 figures are taken from the Proposed Budget (Government Plan) 2026 - 2029.